Overview

In StockUnify, tax rates define how taxes such as GST or VAT are calculated and applied to your sales and purchase transactions.

You can create multiple tax rates to match your business requirements, but only one tax rate can be set as the default.

In StockUnify, every Sales Order or Purchase Order can only apply one tax rate at a time.

Add a New Tax Rate

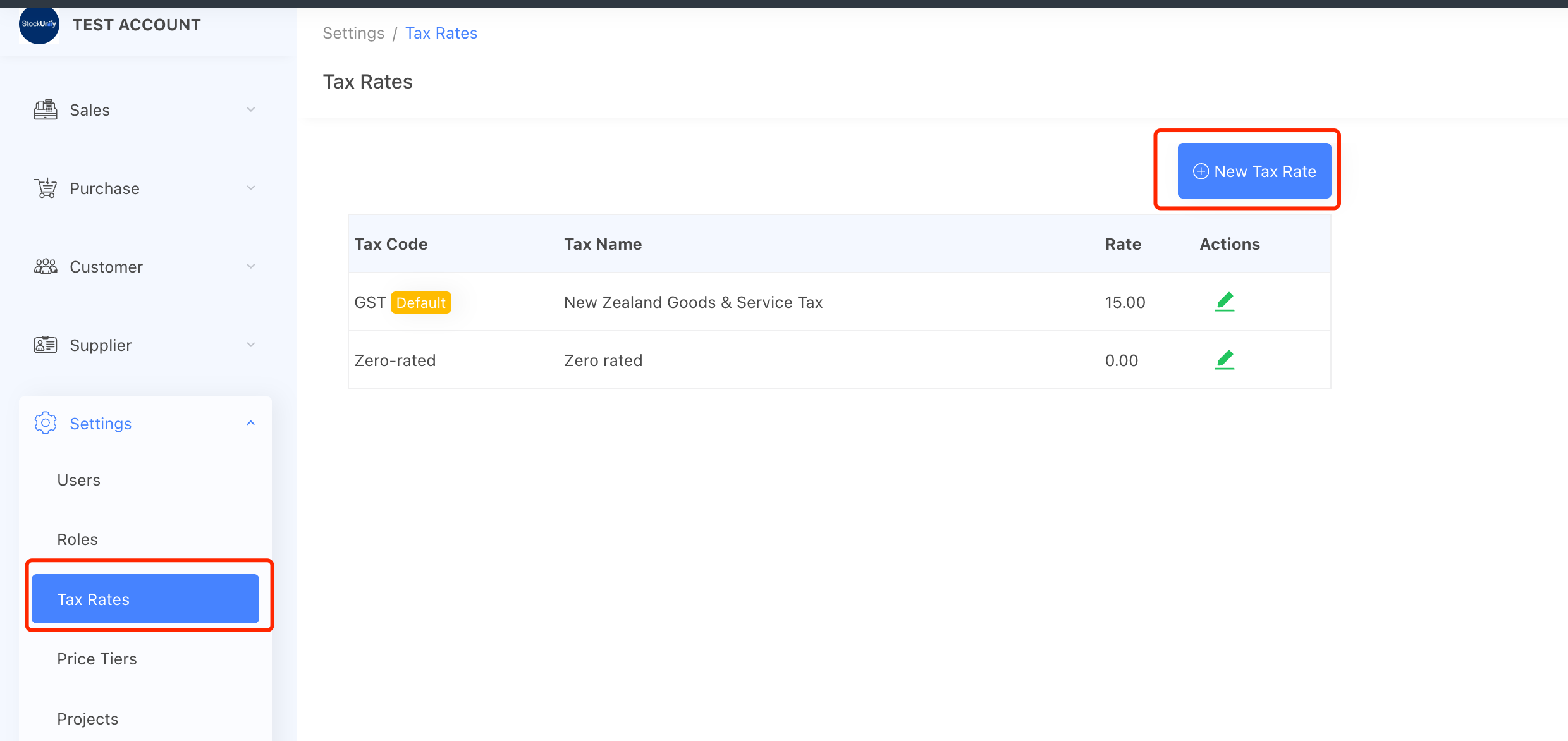

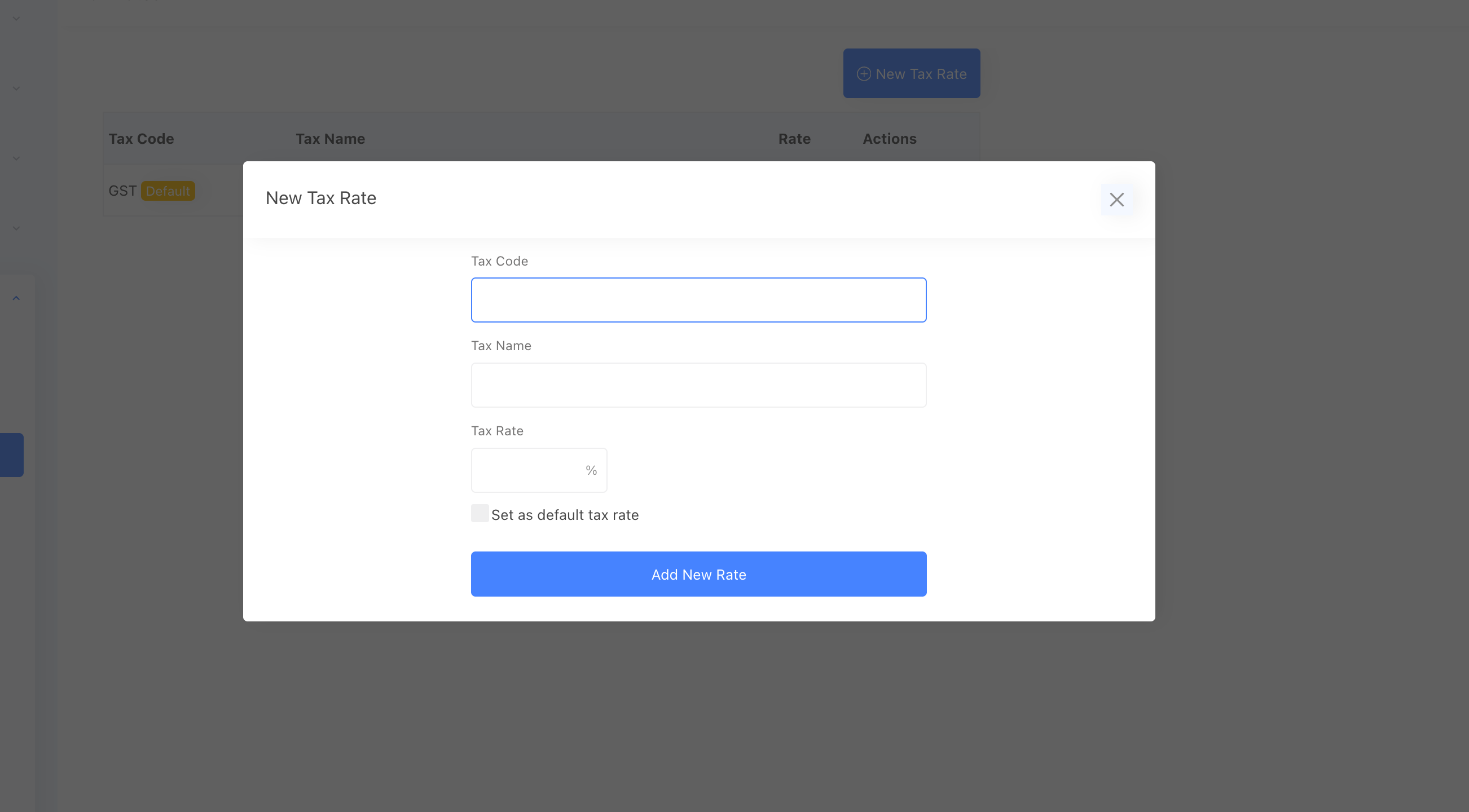

To create a new tax rate, Navigate to the Settings -> Tax Rates menu. Click the New Tax Rate button. then a pop-up window will open.

In the pop-up window, Enter the following details:

- Tax Code — e.g. GST 15%

- Tax Name — e.g. NZ GST

- Tax Rate — numeric value (e.g. 15)

Set a Default Tax Rate

You can set one tax rate as your Default rate. The default rate will be automatically used when you create orders.

Only one tax rate can be set as default at any time.